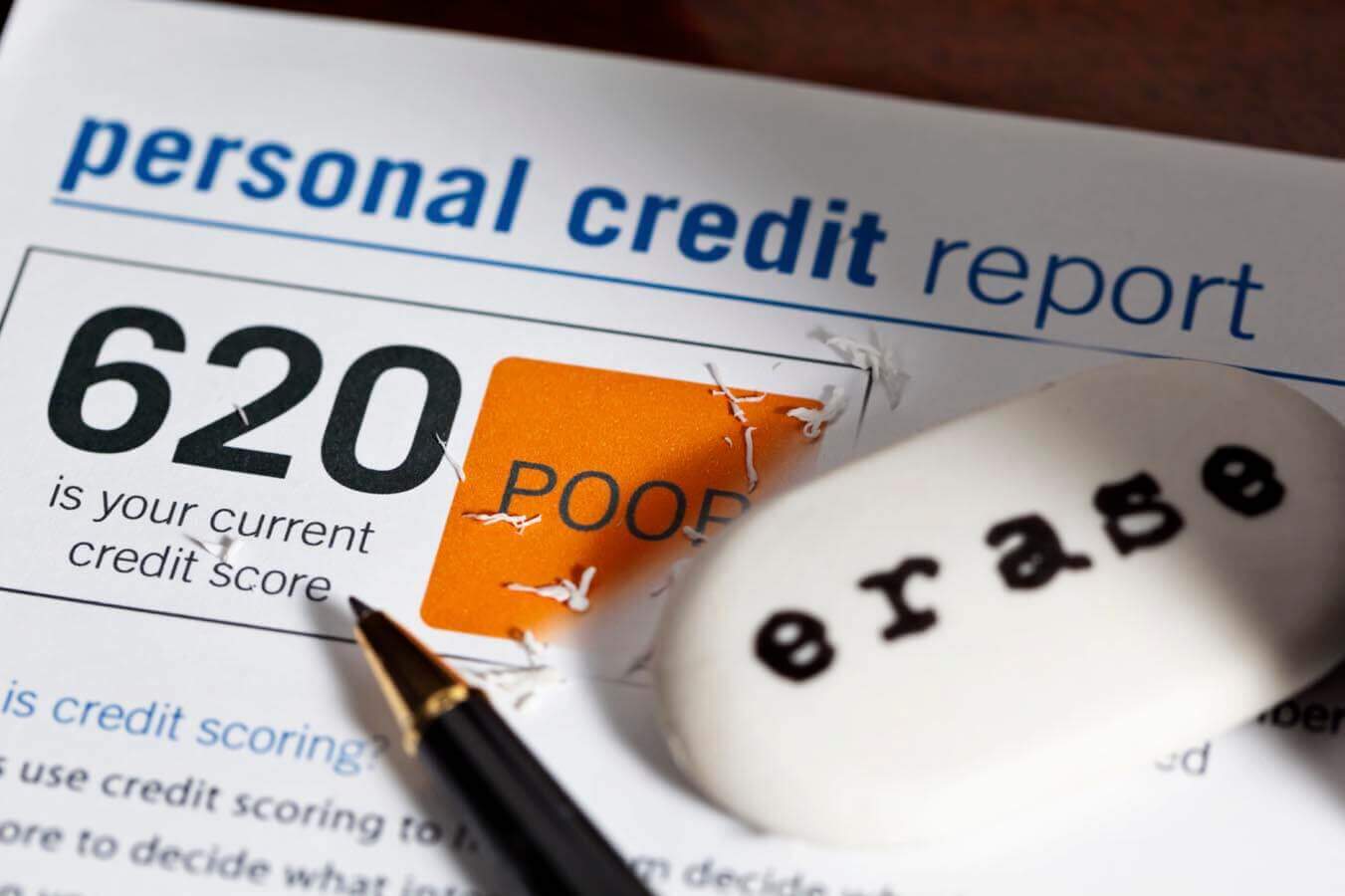

Credit Repair Kemah: Raise Your Credit Rating Today

Wiki Article

Unlocking Financial Opportunities: Recovering Your Credit Rating Via Fixing

The Relevance of Credit Rating

You need to comprehend why credit rating are necessary in order to improve your monetary scenario. Your credit history is a three-digit number that represents your credit reliability. It is important since lending institutions use it to identify whether they should approve your funding application. A great credit report rating can open up a globe of monetary possibilities for you, such as reduced rates of interest, higher credit line, and also far better chances of getting authorized for fundings as well as bank card. On the other hand, a poor credit rating can limit your options and also make it hard for you to secure fundings or acquire positive terms.

Additionally, having a good credit history can likewise help you obtain authorized for an auto loan with positive terms as well as rate of interest. It can even influence your capability to lease an apartment or condo or secure a work, as some companies and proprietors think about credit report as an indication of obligation and reliability.

Comprehending the Variables Impacting Your Credit Report

Recognizing the aspects that impact your credit history is vital for improving your monetary standing. Your debt score is a three-digit number that lending institutions use to assess your credit reliability. It is affected by several aspects that mirror your financial actions and history. One substantial factor is your settlement history. Making timely settlements on your financial debts, such as fundings and credit score cards, demonstrates your dependability as a debtor. An additional variable is your credit report utilization ratio, which is the amount of credit report you are making use of compared to your complete available credit score. Maintaining this proportion low, ideally below 30%, reveals lending institutions that you are responsible with credit history. The size of your credit report additionally contributes. The longer you have actually kept an excellent credit report, the more positively it impacts your rating. In addition, the kinds of credit history you have, such as credit score finances, home loans, and cards, add to your credit history. Lastly, your credit scores inquiries, both soft as well as difficult, can affect your rating. Hard questions occur when you use for credit report, while soft questions take place when you examine your very own credit report. Recognizing these aspects will certainly assist you take the required actions to improve your credit history and also unlock much better monetary chances.

Steps to Fixing Your Credit Report

One of the primary steps in fixing your credit scores rating is to assess your credit scores report for any kind of errors or discrepancies. It is very important to take this step since also a tiny mistake on your credit rating record can have a substantial influence on your credit history. Start by getting a duplicate of your credit scores record from each of the three major credit score bureaus-- Equifax, Experian, and also TransUnion. Carefully go through each report as well as look for any kind of errors such as wrong individual details, accounts that do not come from you, or late settlements that were actually made on time. If you find any errors, you should dispute them with the credit scores bureau that gave the record. This can usually be done online or by sending out a letter clarifying the mistake and also supplying any type of supporting documents. The credit scores bureau will then investigate the disagreement as well as make any type of necessary improvements to your credit record. Keep in mind, making the effort to review and also contest any mistakes on your credit report is an essential initial action towards fixing your credit historyStructure Positive Credit Behaviors

Long-Term Methods for Maintaining a Healthy And Balanced Credit Report

Maintaining a healthy and balanced credit report rating in the long-term involves regularly practicing positive credit report behaviors and also being conscious of your investing and payment practices. It is very important to comprehend that your credit rating is a reflection of your monetary responsibility and can impact your capacity to safeguard loans, rent out an apartment, and also also get a job. To maintain a healthy credit report, you must begin by paying your costs on time. Late payments can have an unfavorable impact on your credit rating, so it's critical to remain on top of your due days. Furthermore, keeping your credit rating use reduced is essential. Purpose to make use of no even more than 30% of your available credit to demonstrate that you can handle your financial obligations properly. Another vital element is staying clear of extreme credit scores applications. Each time you request credit rating, it can cause a hard questions on your credit scores report, which can lower your score. Ultimately, routinely checking your credit record for mistakes or dubious activity is crucial. By being positive as well as dealing with any type of problems, you can maintain a healthy credit rating in the future.Verdict

In conclusion, taking the required steps to repair your credit history can open up a globe of financial possibilities for you. By understanding the elements that impact your credit rating score as well as carrying out the ideal methods, you can restore your credit score and also develop positive credit history practices for the long term. Remember to remain self-displined as well as constant in your efforts, and also you will certainly be well on your method to maintaining a healthy and balanced credit history. So proceed, take control of your financial future and unlock the opportunities that await you.A good credit history score can open up a globe of monetary opportunities for you, such as lower interest prices, higher credit scores limitations, and far better possibilities of getting accepted for fundings and credit cards. An additional look at here now variable is your debt navigate to this site use proportion, which is the amount of credit rating you are making use of compared to your overall readily available credit rating. In addition, the types of debt you have, such as debt cards, home loans, and financings, add to your credit report score. It's important to take this action since also a little error on your credit report can have a substantial impact on your credit rating. By recognizing the factors that affect your credit history score as well as executing the appropriate techniques, you can restore your credit rating as well as develop positive credit report routines for the lengthy term.

Report this wiki page